Warren Buffett has made headlines in the last few years regarding his involvement in the solar industry via Berkshire Hathaway’s ownership of MidAmerican Energy (now a subsidiary of Berkshire Hathaway Energy). Most notably, the company’s subsidiary NV Energy battled the rooftop solar industry in Nevada, including Elon Musk’s SolarCity (now owned by Tesla). Buffett strongly supports renewable energy with Berkshire Hathaway Energy (BHE) and noted in his 2015 annual letter to shareholders that the company has invested nearly $16 billion in renewables and now owns 7% of wind generation and 6% of the solar generation in the U.S. Buffett favors the economics of utility scale solar versus rooftop solar and believes net metering unfairly shifts costs to non solar customers. Although Buffett’s business interests may not be aligned with rooftop solar, he is notoriously frugal on personal expenditures, so we asked our analysts to research whether the returns would pencil out for Buffett to put solar panels on his roof.

Solar in Omaha?

Warren Buffett has lived at the same house in Omaha for more than 50 years, which he bought in 1957 for $31,500.

(Photo Credit: Forbes)

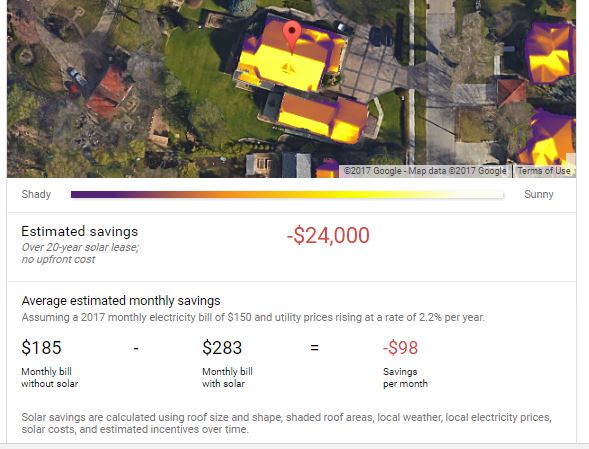

We looked up the house on Google’s Project Sunroof, which analyzes a home’s rooftop for solar production potential and estimates savings based on utility costs in that area….ouch! The return on rooftop solar for Buffett is actually negative, which is primarily driven by the low cost of retail energy in Nebraska, which ranks #7 in the U.S. for the lowest cost of energy. Nebraska’s Solar Report Card shows a D with an internal rate of return of 4.4% due to low retail electricity rates and a lack of incentives. So the answer to our original question is a clear “No”, but are there lessons we can apply from Buffett’s investing philosophy to investing in solar energy?

Applying Buffett’s Investing Principles to the Solar Decision

Buffett has generated returns of 20.8% since 1965 for Berkshire compared to the S&P of 9.7% (that’s the difference between 127x and 8,884x), so there is a lot to learn from his investing style. Here are a few Buffett investment tips that we think apply to a homeowners decision to go solar.

Pay a Fair Price

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”

Solar can make a great investment in some states, such as New York, California and Massachusetts, where cash returns on solar can be greater than 15%, which compares favorably to the S&P. But these returns assume homeowners pay market prices and will decrease significantly if consumers overpay for solar. So it is important that consumers know how much solar costs and pay a fair price. Our review Q4 review of solar in California indicates that the median price per watt is just under $4.50.

Focus on Cash Flow and Use Conservative Assumptions

“In order to calculate intrinsic value, you take those cash flows that you expect to be generated and you discount them back to their present value – in our case, at the long-term Treasury rate.”

There is a lot of research on how solar panels increases home values, which should provide a homeowner comfort that they will recoup the costs of their solar panels if the decide to sell their home. However, the best approach to evaluate solar is to understand the cash utility savings and how those compare to your cash investment, loan or PPA payments. Furthermore, it is best to use very conservative assumptions regarding future utility rates – don’t buy solar panels if you will only start to realize savings in 5 years assuming utility rates increase at 10% a year. Focus on year one savings and assume 2%-3% utility rate increases.

Understand Your Circle of Competence and Keep it Simple

“Never invest in a business you cannot understand.”

Solar sales reps can put on a great presentation. Make sure you understand all the assumptions, including the price, tax incentives, and production estimates and don’t sign a contract until you can simply write out the savings estimates on your own. If you don’t understand it, take the time to do your own research on key considerations, such as the lease vs. buy decision.

Partner With People that You Can Trust

“Intelligence, energy, and integrity. And if they don’t have the last one, don’t even bother with the first two.”

The best way to make a smart solar decision is to find a solar company that has integrity and that you can trust. The rest of the considerations – a proper installation, the best solar panel brands, a fair price will fall into place if you find the right company. Refer to our guide on how to choose a solar company before signing a contract.